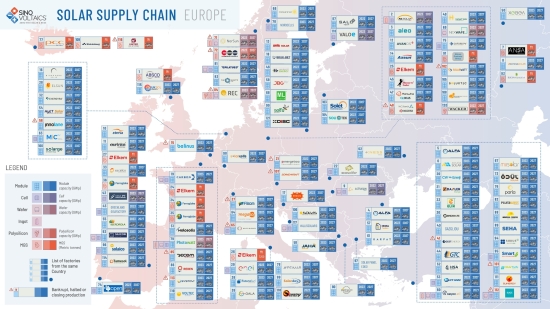

Europe Solar Supply Chain Map Edition 1 - 2025

May 2025

The Sinovoltaics Supply Chain Map (SSCM) - Europe for Edition 1 2025 includes several notable changes since our last report.

Thanks to market feedback, the 2025 first edition of the Europe, Mediterranean & Turkey Solar Supply Chain Map has some notable revisions and additions.

In general, the EU market is facing challenges with several bankruptcies. The EU’s opportunities are now aligned with the Clean Industrial Deal proposed by the EU Commission, which should help revitalize the Solar PV manufacturing in Europe, although more support measures will still be needed.

To recap the latest updates:

- EU Module Manufacturing

- Kivanc has been added to this edition of Sinovoltaics’ Solar Supply Chain Map. Their goal is 1.2 GW of module production and 5 GW of cell manufacturing.

- Elite Solar is looking to manufacture 8 GW in Egypt.

- SC Heliomat is aiming to manufacture 1.5 GW in Romania.

- Sunart PV Enerji has also been added to the Map with 300 MW of production in Turkey.

- EDF decided to shut down Photowatt and Systovi has also gone into liquidation.

- RECOM Silia has also halted their production in France.

- Gest Enerji, Suoz Energy Group and Solar Turk have closed their doors in Turkey.

- Innolane has gone bankrupt in the Netherlands.

- Solarwatt has also decided to close its manufacturing site in Dresden, Germany.

- Despite previously announcing 5 GW of production in Belgium and Georgia, Belinus has also gone bankrupt.

- Energetica filed for insolvency in December 2023.

- Cell

- Meyer Burger has stopped module production but is retaining its 500 MW cell production facility in Switzerland. There are ongoing negotiations with bondholders about restructuring.

- Polysilicon/Ingot

- Norwegian Crystal went bankrupt in August of 2023. Also, NorSun discontinued manufacturing in Norway along with REC, abandoning their polysilicon factory in Norway in 2023.

Currently Europe, the Mediterranean, and Turkey have a combined nameplate PV module production capacity of 21 GW and ambitions to jump towards 70 GW by roughly 2030. The larger portion of the region’s manufacturing hub is in Turkey.

The current combined nameplate cell capacity is 3.2 GW, but press releases indicate the capacity may grow to 55 GW by 2030.

This increased cell capacity coincides with an ingot growth from 1.5 GW to 24 GW by the same time period along with 126700 metric tonnes of Metallurgical Grade Silicon (MGS).

For more detailed PV insights and analysis of the European solar market, including emerging trends and future projections, refer to the full Europe Solar Supply Chain Map Edition 1 - 2025.

If your solar manufacturing project isn't listed or has been updated, please reach out to us at contact@sinovoltaics.com to have your details listed and share your latest developments. We'll include them in our next release.