North America Solar Supply Chain Map

Edition 1 - 2025

February 2025

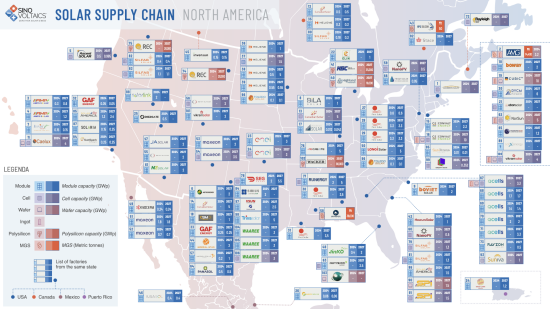

The Sinovoltaics Supply Chain Map (SSCM) - North America for Edition 1 2025 includes several notable changes since our last report.

- Several new factories have been added. These include Amps Solar, Boviet Solar, DYCM Power, Ebon Power, Imperial Star Solar, NuVison, EsFoundry, ReCreate, and Toyo/VSUN.

- Capacity reductions. Meyer Burger has scrapped its plans for a 2GW cell manufacturing site in Colorado.

- We’ve corrected the manufacturing capacity of First Solar in Mexico. Their total capacity is 21.2 GW, including non-North America sites.

- Capacity expansion totals have been updated. SSCM - North America for Q2 shows a total of 31.92 GW of module production capacity spread throughout Mexico, Canada, and the US. These manufacturers are now forecasting an expansion of 97.9 GW in the coming 3 - 6 years (a total of 129.9 GW).

- North American cell production is still constrained. Although manufacturers are making great strides in increasing cell production from 8 GW to 64.9 GW by 2027/2030 (with entries like EsFoundery) and wafer production from 3.2 GW to 24.5 GW by 2027/2030, current cell capacity remains the Achilles heel of the market.

- Polysilicon production is also constrained. The main polysilicon suppliers in North America are now Hemlock Semiconductor, Wacker Mississippi Silicon, and Highland Materials, with an estimated total of 171,000 metric tons of production capacity.

For more detailed PV insights and analysis of the North American solar market, including emerging trends and future projections, refer to the full Sinovoltaics Solar Supply Chain Map report.

If your solar manufacturing project isn't listed or has been updated, please reach out to us at contact@sinovoltaics.com to have your details listed and share your latest developments. We'll include them in our next release.