Sinovoltaics Maps 86.5 GW of PV Module Capacity Across Southeast Asia Amidst Strategic Manufacturing Shifts

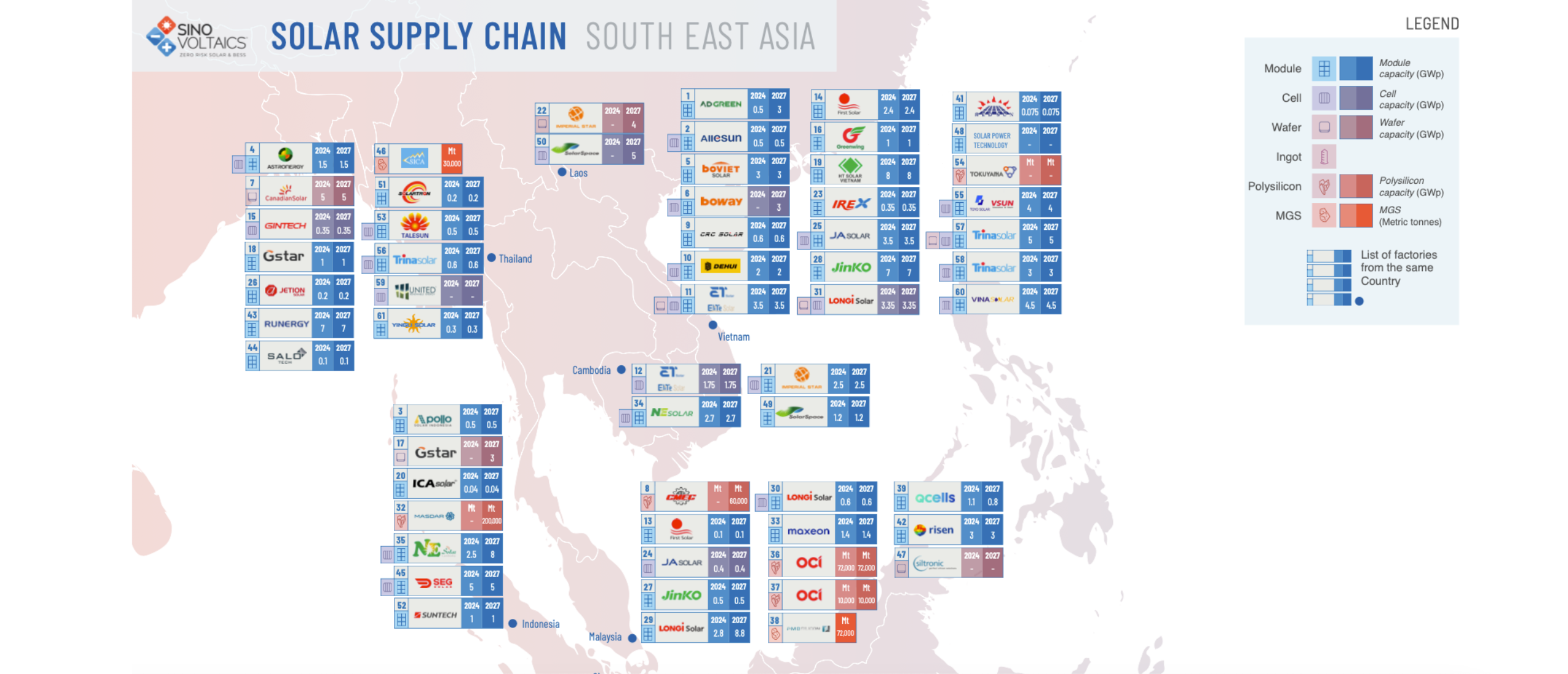

Lausanne, Switzerland – June 26, 2025 – Sinovoltaics, the Dutch-German technical compliance and quality assurance leader in solar photovoltaic and energy storage industries, has released the latest edition of its Southeast Asia Solar Supply Chain Map. This analysis reveals that Southeast Asia’s combined nameplate PV module production capacity has reached 86.5 GW, with 61 active production projects tracked across the region.

The first edition of the Sinovoltaics Southeast Asia Solar Supply Chain Map for 2025 is available as a free download. It tracks sites producing PV modules, cells, wafers, ingots, polysilicon, and metallurgical-grade silicon, based primarily on public announcements.

Since the previous edition, two new projects have been added, including ICA Solar and United Renewable Energy, reflecting evolving market participation.

Despite strong capacity ambitions, targeting 101 GW module capacity and 69.8 GW cell production by 2028–2030, the sector is facing serious challenges. "Southeast Asia initially served as a workaround to trade barriers targeting Chinese manufacturers, but new U.S. import tariffs are causing sharp reductions in operational capacity and even temporary factory shutdowns,” explained Dricus de Rooij, Chief Executive Officer at Sinovoltaics. “As a result, the region's manufacturers are now redirecting exports toward European markets and exploring alternative manufacturing bases."

The shift in manufacturing focus is becoming increasingly evident. While Cambodia, Vietnam, and Thailand have traditionally dominated production, recent developments suggest a pivot toward Laos and Indonesia. There is also growing interest in the Middle East and Africa. Sinovoltaics confirms that it will launch a dedicated Middle East Solar Supply Chain Map in the coming months to provide further insights into these emerging dynamics.

The updated Southeast Asia map also outlines forecasts for vertical integration. Ingot capacity is expected to nearly double from 16 GW to 30 GW by 2030. Polysilicon production is projected to grow from 82,000 tons to 342,000 tons. MG-Si production is also expanding, with 102,000 metric tons already online.

However, the broader implications of U.S. trade policy remain uncertain. “Although these policies may eventually spur investment in domestic U.S. solar manufacturing, current signs suggest that a full decoupling from the Chinese and South-East Asian supply chain, especially for wafers and cells, is unlikely in the near term,” de Rooij added.

The Sinovoltaics Supply Chain Map Southeast Asia report is free to download.

About Sinovoltaics

Since 2009, Sinovoltaics, a Dutch-German Battery Energy Storage (BESS) and solar photovoltaic (PV) technical compliance and quality assurance service firm, has been a pioneer in the BESS and solar photovoltaic industries. With SELMA (Sinovoltaics’ EL Mass Analysis) software and industry leading Zero Risk Solar® guarantee, Sinovoltaics’ mission is to eliminate all photovoltaic and BESS product defects, enabling investors and the world to succeed with minimal investment risks.

Sinovoltaics’ services include quality assurance inspections, factory audits, Environmental, Social, and Governance (ESG) reports, and traceability audits for utility solar developers and investors. The company maintains a global presence with offices in Switzerland, the United States, Hong Kong, mainland China and Vietnam, as well as factory inspection and audit teams strategically located in Vietnam, Türkiye, Thailand, China, Malaysia, Cambodia, South Korea, India, U.S., and other key manufacturing bases.

Media Contact

Rasa Jakaitis

Media Manager

rasa@sinovoltaics.com

+37060152349

Lithuania

Read more of our ->> press releases.