In March this year, we released the first Altman Z-Score on Sinovoltaics.com, outlining which Asian PV manufacturers are most likely to go into bankruptcy and which PV manufacturers come out strongest.

Since March this year, the PV market has changed significantly with an emphasis on oversupply in Q3 & Q4 (see Financial Post, PV-Tech, etc.).

The main cause for the oversupply has been this year’s production expansion amongst Asian manufacturers (> 18GW of solar module capacity) and a sudden slowdown in demand in China, caused by a cut in subsidies in June.

The current situation looks similar to the boom-bust cycle we’ve seen back in late 2011, which resulted in a wave of consolidation as prices plunged and losses piled up.

Are we in for the next wave of consolidation in our industry?

Seen the turbulent times, we’ve decided to publish a new Altman Z-Score analysis and share which PV manufacturers are now financially strong and which carry the risk of going into bankruptcy.

What happens to solar module warranties when a manufacturer goes bankrupt?

When a PV manufacturer goes bankrupt, its product- and performance warranties will no longer be valid. Valid warranties are important for PV plant developers and PV project owners who want to safeguard their project ROIs. A product warranty is important to cover defects related to the solar module’s workmanship while a performance warranty is important to have in place in case solar module’s degrade faster than anticipated and their output is lower than expected.

One solution to eliminate bankruptcy risk is to purchase a solar module warranty insurance, such as the Solarif warranty insurance.

How to assess the risk of your manufacturing partner going bankrupt, without devoting a complete study to its financial reports?

One proven and fairly quick way to predict if a PV manufacturer may face bankruptcy within the next 2 years is the Altman Z-Score.

To learn more about Altman Z-Score and how it’s calculated, see our previous post.

Q3 2016: how do Asian PV manufacturers rate on the Altman Z-score?

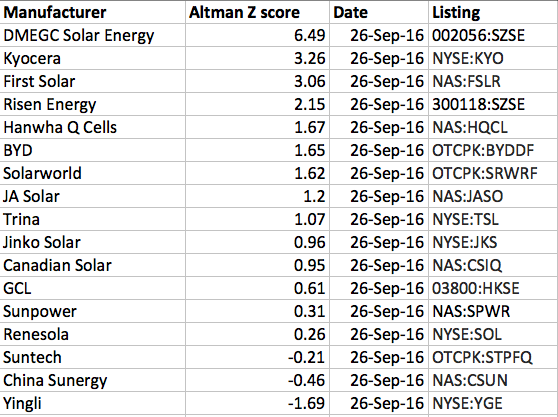

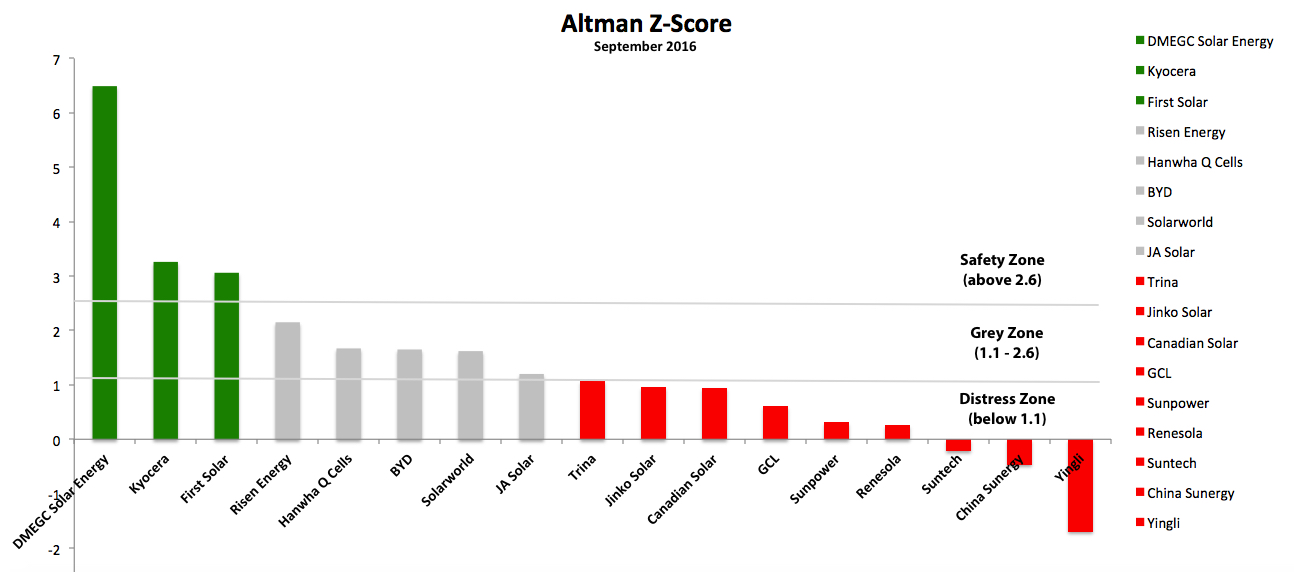

The following table shows the Altman Z-Scores of major, publicly listed Asian, European and American manufacturers at the end of the 3rd Quarter of 2016.

Altman Z-Scores Asian manufacturers September 2016 (Source: gurufocus.com)

The Altman Z-scores of major European and American manufacturers such as Solarworld, First Solar, and Sunpower have been included to compare their financial state with that of Asian manufacturers.

Click on the graph to enlarge:

Interestingly, Chinese manufacturer DMEGC Solar Energy is leading the chart and, with a score of 6.49, leaves behind all other PV manufacturers in the graph. DMEGC Solar Energy is part of the Hengdian Group DMEGC Magnetics Co (DMEGC) and has currently 1.6 GW of solar cell manufacturing capacity, a 500MW wafer, and 900MW of module assembly capacity.

Other manufacturers in the top ranks are US-American First Solar, Japanese Kyocera, and Chinese Risen Energy – the latter two with a higher Z-score than 6 months ago.

Similar to our analysis in March this year, Yingli still ranks at the very bottom with a score of -1.69 (unfortunately further declined, from -1.18 in March 2016). Any company ranked below a score of 1.1 is in the Distress Zone, which means it’s likely to face bankruptcy within the next 2 years. Also, companies China Sunergy, Suntech, and Renesola are amongst the players at the bottom.

Altman Z-Score and limiting real-world factors

In our first Altman Z-Score article we already outlined that while the Altman Z-Score is quite reliable to make proper judgments on the financial shape of a PV manufacturer, there are of course many more local factors that can come into play in the wake or aftermath of a bankruptcy of a manufacturer.

Such factors can be the strategic importance of a manufacturer, the number of people employed, unique technologies or intellectual properties, shareholder interests, and so on.

Exemplifying the case of China (but also of course applicable to other countries), companies with strategic importance to (local) governments, are likely to enjoy some degree of support when filing for bankruptcy.

Do you want access to Altman Z-Scores of all leading PV module manufacturers? Access Full Version: Altman-Z Report with 60+ PV module manufacturers for FREE.

Robbo

on 16 Oct 2017Dricus

on 01 Nov 2017Greg M

on 01 Dec 2016Geof Moser

on 27 Oct 2016Alban Thurston

on 26 Oct 2016Kausiek Banerjee

on 18 Feb 2017Dricus

on 27 Oct 2016Craig Donohue

on 11 Oct 2016Avinoam Ben Dor

on 08 Oct 2016Sutaik Baik

on 07 Oct 2016Ranjith Prem

on 07 Oct 2016Asanka

on 04 Oct 2016