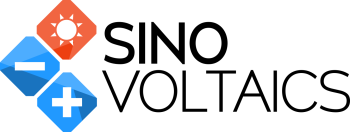

In this free edition of the Q3-2017 Altman Z-Score of PV Module Manufacturers, we rank 18 leading PV module manufacturers according to their financial strength. Comparing Q3-2017 Altman Z-Score data with Q2-2017 data, we also look at the overall score trend development of each PV module manufacturer.

Our Altman Z-Score report answers the following questions:

Which PV module manufacturers are financially strong? and which manufacturers are in the risk zone of going bankrupt within the coming 2 years?

Why does Sinovoltaics Group publish this report?

The financial strength of PV module manufacturers directly relates to their capability of fulfilling warranty obligations in the long term.

Solar module product and performance warranties are typically valid as long as the manufacturer is around. Bankrupt manufacturers unfortunately don’t fulfill warranty obligations.

This is of course nothing new:

We’ve seen multiple manufacturers leaving the stage over the past years, leaving project owners with an increased warranty risk, including LDK, Solyndra, Suntech Wuxi, Bosch etc. and the most recent bankruptcies of Suniva and Solarworld this year shows that picking a financially healthy manufacturer is more relevant than ever.

How do we apply the Altman Z-Score ourselves?

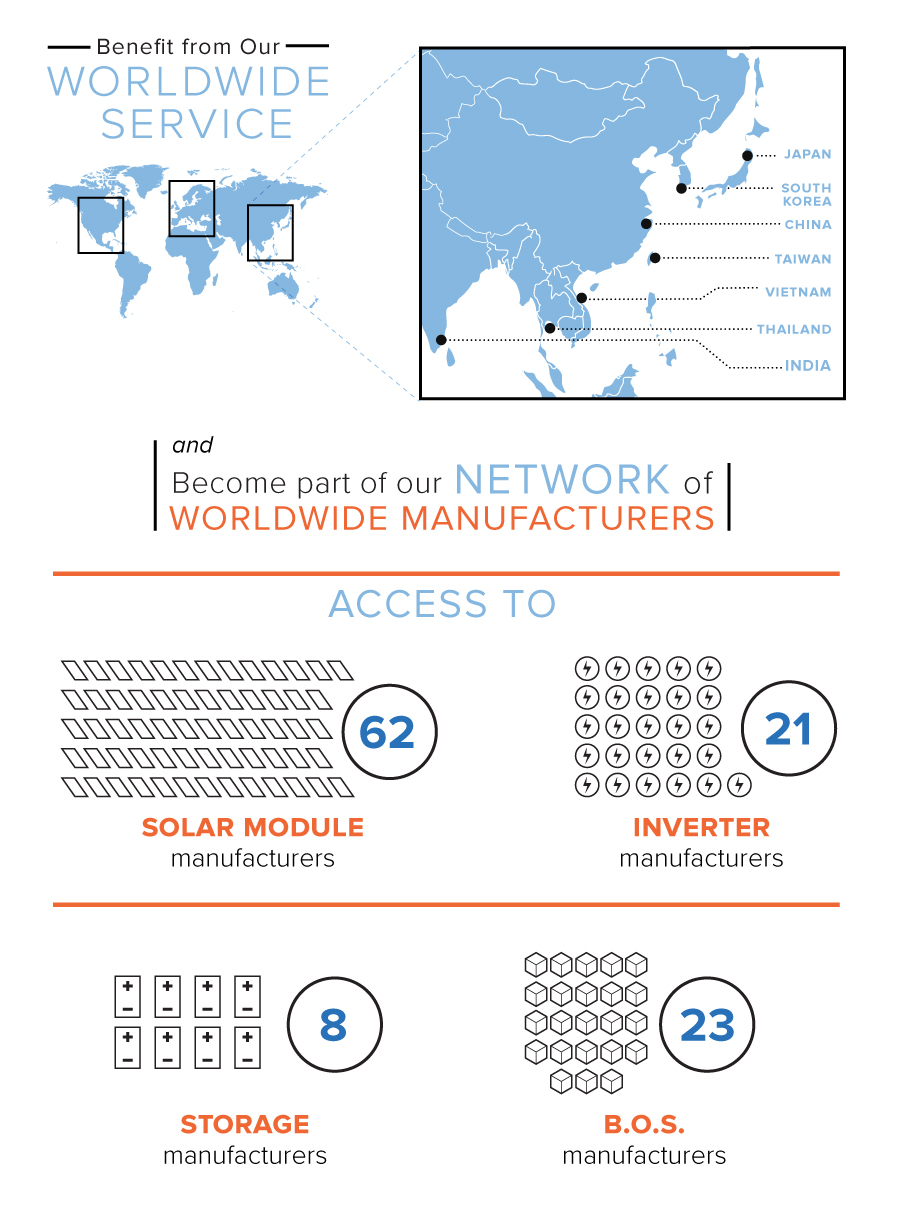

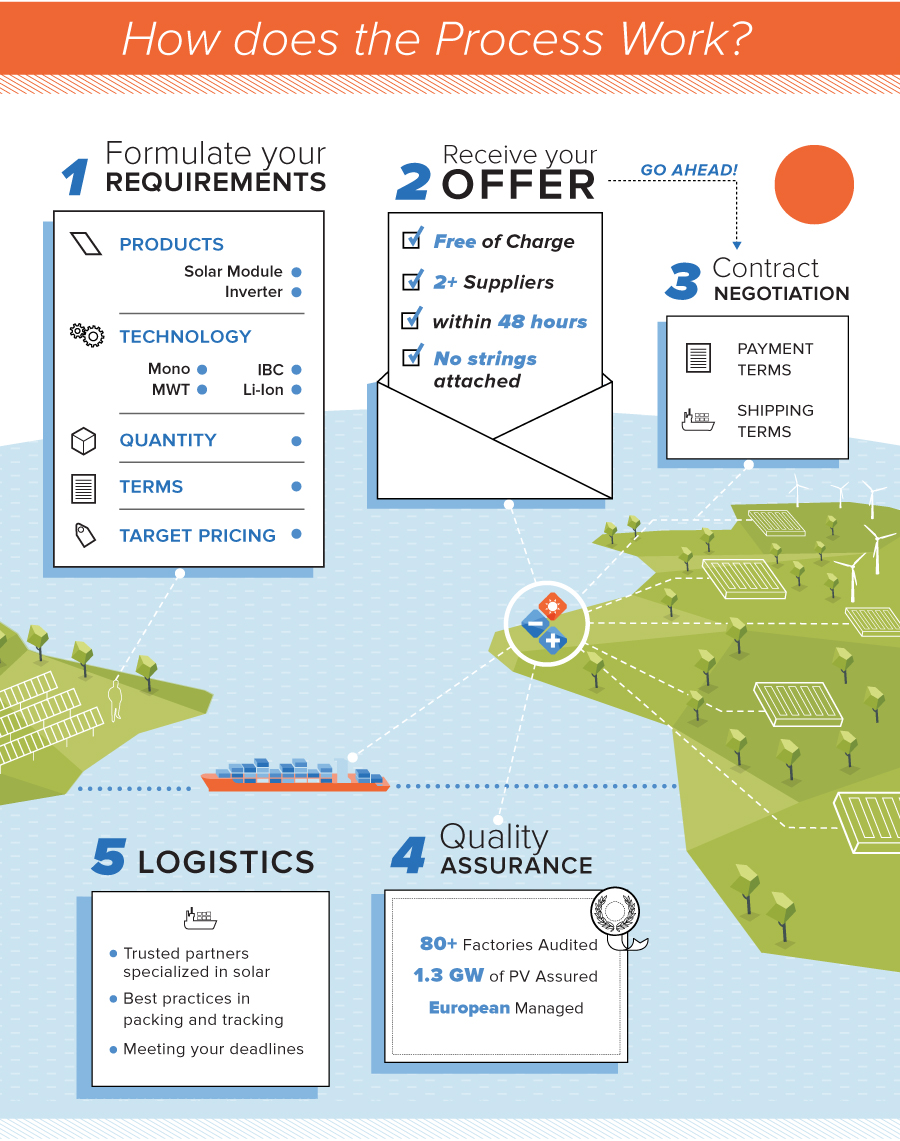

Sinovoltaics Group assists EPC’s, project developers, and financiers worldwide with purchasing quality solar modules and components in Asia. Besides a ‘best pricing guarantee’, our clients benefit from an experienced team of quality engineers on-site at the factories, to inspect every single shipment leaving the factories.

In addition to the physical quality assurance of the PV components, most buyers appreciate background checks on the PV manufacturer they’re buying from, of which the Altman Z-score analysis is an important element.

Edition 3, 2017: how do PV module manufacturers rate on the Altman Z-score?

The following table is a selection of Altman Z-Scores of the major, publicly listed Asian, European and American manufacturers in Q3 – 2017:

Click on the graph so see in full size:

In this new edition we see DMEGC maintaining the first position on the list, and even continuing its upward trend further by improving its Altman Z-score from last quarter from 7.93 to 10.39.

A new company listed in the Green Zone is Linyang Photovoltaic, which is part of Linyang Energy, a company specialized in photovoltaics, energy saving and smart energy products.

While most of the companies in the Greenzone, such as Firstsolar, are able to maintain a very stable position, unfortunately there are a number of players in the Red Zone that we see deteriorating quickly.

Companies Yingli and Renesola see their scores further diminishing. Recent news underline and reflect these worsening scores, as Renesola recently announced to cease to produce solar modules and from now on will solely focus on downstream solar farm development.

What is the Altman Z-score?

The Altman Z-score is a formula to predict bankruptcy. This formula is used to predict corporate defaults and the status of financial distress. The formula uses the factors profitability, liquidity, leverage, activity and solvency to predict if a firm will go into bankruptcy within two years.

As the Altman Z-score was originally designed to assess public manufacturing companies with assets of more than USD 1 million, this formula is an excellent way to assess which PV module manufacturers may be in trouble within the next 2 years.

The formula is nowadays widely accepted by auditors, accountants, courts and database systems used to evaluate loans.

The formula dates from the 1960’s and was published by Edward L. Altman, who back then was working as an Assistant Professor of Finance at New York University.

Altman Z-score: how likely is a PV module manufacturer to go bankrupt within the next 2 years?

How reliable is the Altman Z-score formula?

The Altman Z-Score isn’t perfect, however we’d say it’s reliable enough to make a proper judgment on the financial situation of a PV module manufacturer:

Between 1968 and 1999 the formula has been put to the test multiple times. The model was found to be about 80-90% accurate in predicting bankruptcy one year before the event (with a Type II error, classifying the firm as bankrupt when it does not go bankrupt of approximately 15%–20%*).

(*Source: pages.stern.nyu.edu/~ealtman/Zscores.pdf)

How’s the Altman Z-score calculated?

Altman Z-Score formula = 1.2A + 1.4B + 3.3C + 0.6D + 1.0E

The original formula is broken down as following:

A = Working Capital/Total Assets: measures liquid assets in relation to the size of the company

B = Retained Earnings/Total Assets: measures profitability that reflects the company’s age and earning power

C = Earnings Before Interest & Tax/Total Assets: measures operating efficiency apart from tax and leveraging factors. It recognizes operating earnings as being important to long-term viability

D = Market Value of Equity/Total Liabilities: adds market dimension that can show up security price fluctuation as a possible red flag

E = Sales/Total Assets: standard measure for total asset turnover

How are the the Altman Z-scores interpreted?

The scores are categorized into 3 zones called the Safe Zone, Grey Zone and Distress Zone:

Safe Zone = Z > 2.6

Grey Zone = 1.1

Distress Zone = Z

How to interpret the companies in the ‘GREY ZONE’?

With a large number of companies in the ‘Grey Zone’, how to interpret these scores when selecting a manufacturer?

While ideally a manufacturer is in the ‘Green Zone’, some companies have been consistently in the Grey Zone for years.

Take for instance HT SAAE. Here a number of Altman Z-Scores over the years:

2.28 on Dec ’13

1.75 on Dec ’14

1.88 on Dec ’15

1.81 on Dec ‘16

1.51 on Jun ‘17

Currently HT SAAE stands at 1.24 (October 2017)

Even though HT SAAE’s AZ score has been slightly diminishing over the years, these numbers do show that HT SAAE has been stable for years. Add the fact that HT SAAE is a state owned company under China Aerospace Science and Technology Corporation, and they may just as well be one of the most solid companies on the list.

You could argue the same for known players such as BYD, JA Solar and Risen Energy. As you can see each of these companies show a rather stable score since early 2016:

| BYD 2.23 (Oct, 2017) | JA Solar 1.16 (Oct, 2017) | Risen Energy 2.04 (Oct, 2017) |

What happens to solar module warranties when a manufacturer goes bankrupt?

When a PV manufacturer goes bankrupt, its product- and performance warranties will no longer be valid. Valid warranties are important for PV plant developers and PV project owners who want to safeguard their project ROIs. A product warranty is important to cover defects related to the solar module’s workmanship while a performance warranty is important to have in place in case solar module’s degrade faster than anticipated and its output is lower than expected.

One solution to eliminate bankruptcy risk is to purchase a solar module warranty insurance, such as the Solarif warranty insurance. Another solution is to make 100% sure that you’re purchasing a quality solar module. Sinovoltaics is a specialized company which can help to safeguard the quality of your solar components.

Altman Z-Score and limiting real world factors

In our first Altman Z-Score article we already outlined that while the Altman Z-Score is quite reliable to make proper judgments on the financial shape of a PV manufacturer, there are of course many more and local factors that can come into play in the wake or aftermath of a bankruptcy of a manufacturer.

Such factors can be of strategic importance for a manufacturer, number of people employed, unique technologies or intellectual properties, shareholder interests and so on.

Exemplifying the case of China (but also of course applicable to other countries), companies with strategic importance to (local) governments, are likely to enjoy some degree of support when filing for bankruptcy.

Do you want access to Altman Z-Scores of all leading PV module manufacturers? Access Full Version: Altman-Z Report with 60+ PV module manufacturers for FREE.

Are you developing solar energy projects?

Join the Sinovoltaics – Solar Supply Network!

Benkat

on 30 Oct 2017Dricus

on 01 Nov 2017