Edition 3-2019 of the PV Manufacturer ranking Report has been released!

And.. we have a present for you here at Sinovoltaics..

Instead of the usual USD 499 subscription fee, the FULL Sinovoltaics Ranking Report for PV Manufacturers is now available for FREE!

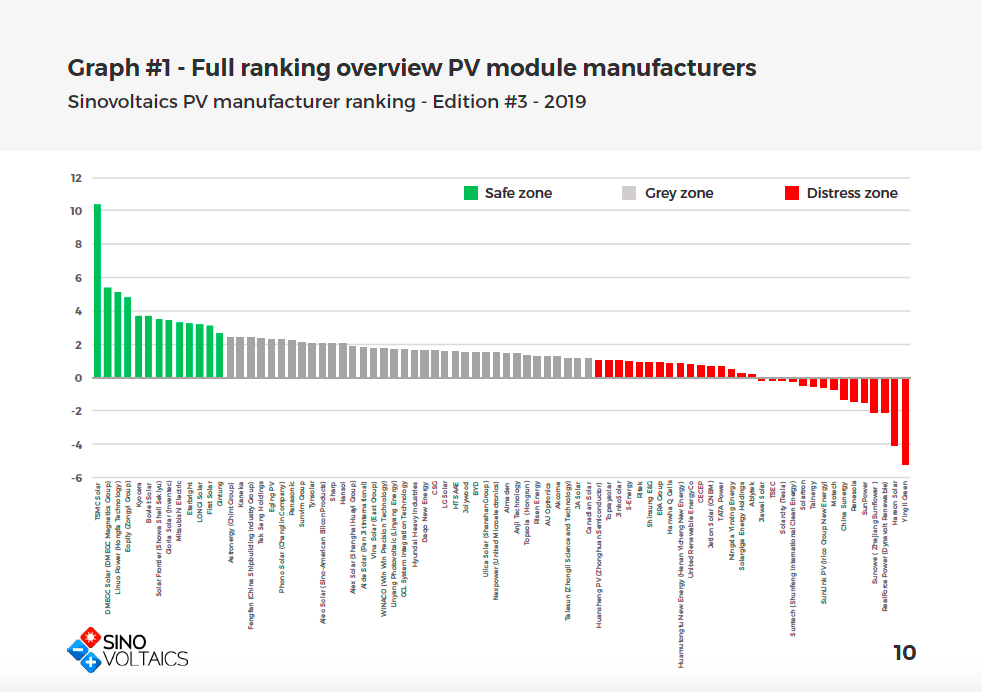

In Edition 3-2019 Sinovoltaics ranks 80 Solar PV Module Manufacturers according to their financial strength.

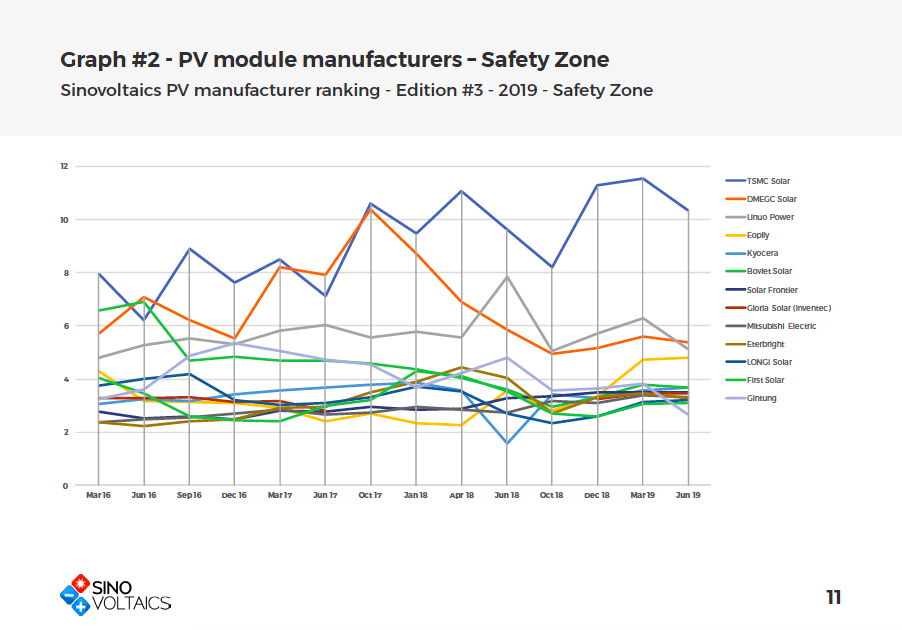

The Altman-Z Scores in this report have been calculated from September 2016 until June 2019, and provide detailed insight how the financial strength of PV manufacturers has evolved over the past 3 years.

Click here to download your free copy of the complete report in .PDF >>>

What’s the value of Altman Z-Scores?

Altman-Z Scores are calculated to understand which PV module manufacturers are financially stable, and which players are at risk of going bankrupt. For any stakeholder involved in solar projects, the financial stability of the manufacturer is of crucial importance. Employing solar PV modules from financially stable manufacturers provides for a better hedge against the potential risks of collapsing return of investment (ROI) of any PV project.

Why is the financial stability of a PV factory important?

Ultimately, the financial stability of a PV module manufacturer is geared to the validity and enforceability of the warranty policies on its modules. Most people realize that today’s PV module manufacturers will probably not be around in 25 years. However for the short to medium term, you want to be sure that warranties are in place.

In many years to come, lots of PV projects will likely face this tough question: whom to contact with performance complaints and replacement requests regarding a malfunctioning module after 2, 5 or even 10 years?

In this report we present you the Altman Z-Scores of 80 solar PV module manufacturers. This report can be used to see how one manufacturer matches up to the other, and can be an important indicator when selecting your PV module manufacturer. The Altman Z-Scores show you which PV module manufacturers are financially strong, and which manufacturers are in the risk zone of going bankrupt within the coming 2 years.

2016 – 2019: rating of PV module manufacturers worldwide

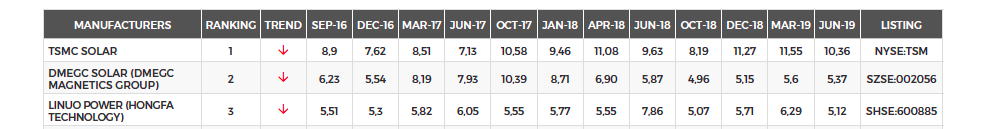

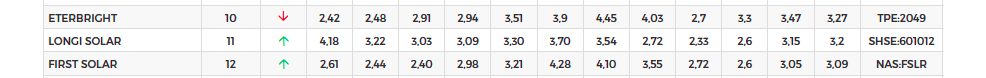

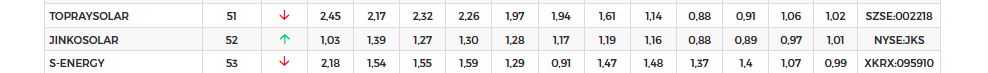

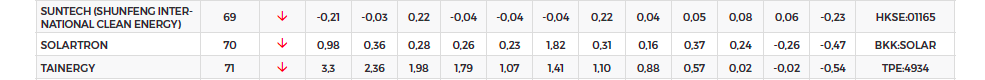

In this report you find the full table showing the Altman Z-Scores of the major, publicly listed Asian, European and American manufacturers.

Here an excerpt from the full report:

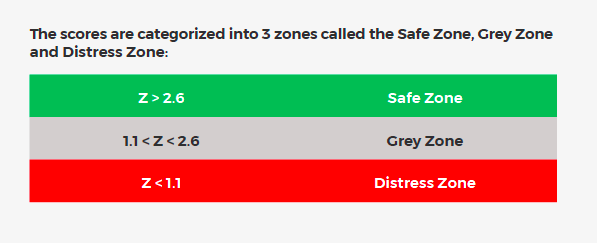

How are the Altman Z-Scores interpreted?

A score below 1.1 is called Distress Zone and it means it’s likely the company is headed for bankruptcy, while companies with scores above 2.6 are in the Safety Zone, financially stable and not likely to go bankrupt.

Note that companies that have been in the Grey Zone for years may be very stable companies!

It’s important to spot the trend and see where a company is heading..

Full Ranking Report Overview PV Manufacturers

Full ranking overview PV Module Manufacturer Ranking Report 3 – 2019

Click here to download your free copy of the complete report in .PDF >>>

Full Ranking Report – PV Manufacturers in the Safety Zone

The following is an excerpt from the full report:

How is the Sinovoltaics Ranking Score calculated?

The Sinovoltaics PV Manufacturer Ranking Score is based on the Altman Z-Score = 1.2A + 1.4B + 3.3C + 0.6D + 1.0E

The original formula is broken down as following:

A Working Capital/Total Assets: measures liquid assets in relation to the size of the company.

B Retained Earnings/Total Assets: measures profitability that reflects the company’s age and earning power

C Earnings Before Interest & Tax/Total Assets: measures operating efficiency apart from tax and leveraging factors. It recognizes operative earnings as being important to long-term viability.

D Market Value of Equity/Total Liabilities: adds market dimension that can show up security price fluctuation as a possible red flag

E Sales/Total Assets: a standard measure for total asset turnover