A Sinovoltaics webinar co-hosted with Colt Shaw (US of OPIS), Serena Seng (APAC of OPIS), Benita Dreesen (European Renewables of OPIS), and Benoit van der Maas (Sinovoltaics) on the latest global PV module market trends. Click here to watch the recording.

The global photovoltaic (PV) module industry is undergoing transformative shifts, characterized by an unprecedented oversupply, evolving regulatory frameworks, and the need for stringent solar quality control mechanisms. A recent webinar featuring industry experts from OPIS provided valuable market insights into the market dynamics of the Chinese, European, and U.S. PV module sectors. This detailed analysis captures the core trends, challenges, and future projections.

China: The World’s Solar Manufacturing Epicenter Facing a Supply Glut

China's dominance in the global PV module market is unparalleled, with production skyrocketing from 181.8 GW in 2021 to a projected 600 GW in 2024. Domestic installations have similarly surged, with 2023 recording 217 GW of installed capacity, up from 53 GW in 2021. Exports grew significantly, yet a consistent oversupply has exerted downward pressure on prices, with mono-PERC module prices falling by 59% since January 2021.

This oversupply reflects not only the rapid scaling of top manufacturers like JA Solar, Longi, and Trina Solar but also a gap between production capacity and domestic demand for solar energy. Notably, even with a robust export market, including rising shipments to emerging regions like the Middle East and Pakistan, China still faces surplus volumes.

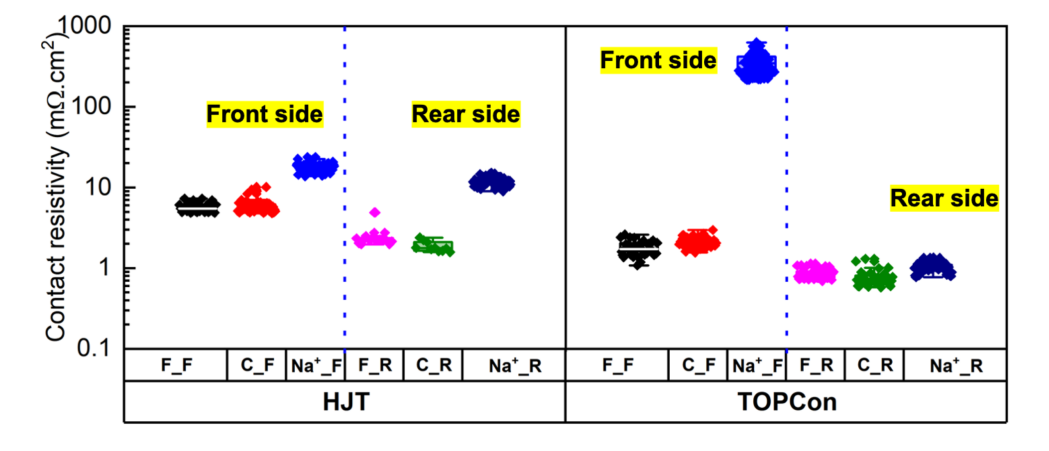

Figure 1: Regulatory Policies and Impact on China’s Solar Industry (Source: OPIS)

Figure 1: Regulatory Policies and Impact on China’s Solar Industry (Source: OPIS)

Regulatory policies are playing a pivotal role. The phasing out of feed-in tariffs, coupled with stricter capital requirements for new PV manufacturing projects, seeks to curb excessive production. However, the full impact of these measures may not be realized until 2025. Market consolidation has already begun in the cell manufacturing segment, signaling potential shifts in the module market in the coming years.

Europe: Strong Growth Amid High Costs and Policy Push

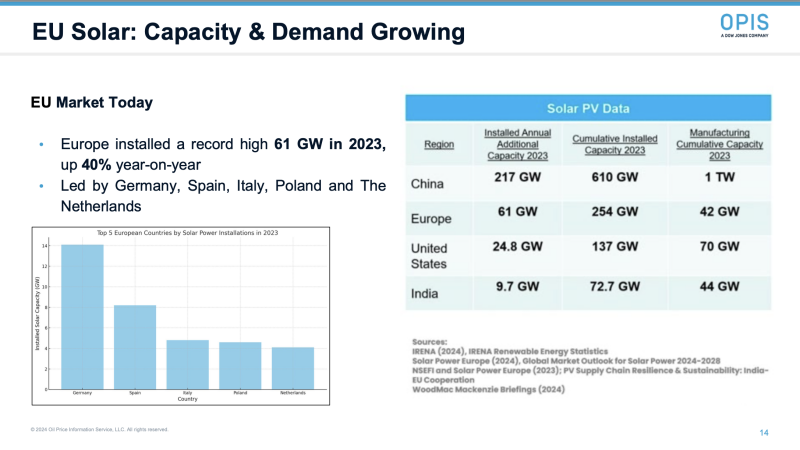

The European solar market continues to thrive, with installations reaching a record 61 GW in 2023—a 40% year-on-year increase. Countries like Germany, Spain, Italy, and Poland lead this growth, driven by Renewable energy regulations, regulatory targets, decarbonization goals, and energy security concerns amid geopolitical tensions.

Figure 2: EU Solar Capacity & Demand Growing (Source: OPIS)

Figure 2: EU Solar Capacity & Demand Growing (Source: OPIS)

However, Europe faces significant hurdles, including grid connection delays, high interest rates, and fragmented national policies. Despite these challenges, the EU has ambitious plans to ramp up domestic PV production under the Net-Zero Industry Act, aiming for 44% of its clean technology demand to be met by EU-based manufacturing by 2030.

European manufacturers struggle with high production costs—105% higher than in China, according to OPIS. This disparity stems from lower economies of scale, higher labor costs, and limited vertical integration. While imported Chinese modules cost around €0.10 per watt-peak, European-made modules hover between €0.30 and €0.40 per watt-peak.

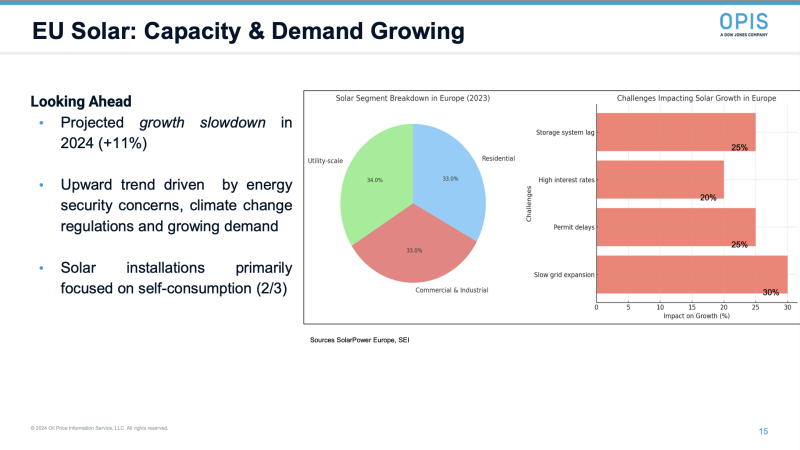

Figure 3: EU Solar Capacity & Demand Growing, looking ahead. (Source: OPIS)

Figure 3: EU Solar Capacity & Demand Growing, looking ahead. (Source: OPIS)

Initiatives like the Distributed Photovoltaic Portfolio (DPP) are attempting to bridge this cost gap by incentivizing the use of European-made modules. Still, the region’s PV manufacturing capacity remains critically low, with only 2 GW of actual production in 2024, far short of its 11 GW target.

United States: Balancing Domestic Incentives and Tariff Pressures

The US solar market operates under conflicting forces. On one side, domestic manufacturers are bolstered by policies like the Inflation Reduction Act (IRA), which provides tax incentives and subsidies for locally produced components. On the other side, project developers face rising costs due to tariffs on imports from China and Southeast Asia.

The Anti-Dumping and Countervailing Duties (AD/CVD) investigation into Southeast Asian suppliers and the expiration of tariff exemptions have led to a rise in module prices from $0.22 per watt in 2022 to $0.28 per watt in late 2024. U.S.-made modules are even costlier, with some prices exceeding $0.40 per watt.

Despite these challenges, domestic production capacity is expected to reach 60 GW by 2025, driven by the establishment of new module assembly plants. However, the U.S. remains reliant on imported cells and wafers due to a lack of upstream manufacturing capacity, which creates bottlenecks in achieving full supply chain independence.

Oversupply: A Global Challenge with Local Implications

Oversupply remains a central theme in all major markets, with Chinese module manufacturers leading the charge. This has resulted in a global price war, putting immense pressure on profit margins. Smaller players are increasingly at risk of exiting the market, and further consolidation seems inevitable.

Europe’s oversupply situation is exacerbated by inventory backlogs, estimated at 60 GW, with many modules idling in warehouses due to delayed projects. Meanwhile, in the U.S., tariff-related uncertainties and bottlenecks in grid interconnection continue to impact project timelines.

Innovation and Quality Control: The Path Forward

Innovation remains a cornerstone for staying competitive. Chinese manufacturers, for instance, have rapidly adopted N-type TOPCon technology, which now constitutes 73% of the domestic market. Europe, too, emphasizes R&D to revive its PV manufacturing sector, focusing on automation, advanced materials, and integrated storage solutions.

From a quality perspective, stringent control measures are critical. Companies like Sinovoltaics advocate for robust contracts that include inspection procedures, quality standards, and supply chain traceability clauses. The use of certified materials and 100% inspection processes, supported by advanced AI software like SELMA, ensures product reliability despite market fluctuations.

Conclusion: Navigating an Uncertain Future

The PV module market is poised for continued growth, driven by global renewable energy targets and technological advancements. However, oversupply, regulatory complexities, and cost disparities pose significant challenges. To thrive in this environment, market players must focus on innovation, cost optimization, and rigorous quality assurance. Consolidation will reshape the competitive landscape, favoring larger, vertically integrated players.

Ultimately, the industry’s ability to adapt to these challenges will determine the pace of the global energy transition and its alignment with climate goals.

If you found this industry review insightful, we invite you to explore the Sinovoltaics Solar Supply Chain Map for comprehensive and detailed PV insights.